Snacking Has Changed — Are You Keeping Up?

Shoppers aren’t grazing like they used to. They’re picking snacks based on price, health, portion, and purpose — and they’re more selective than ever. Healthier doesn’t have to mean bland. Affordable doesn’t have to mean poor quality. And if a snack doesn’t fit the moment, the budget, or their lifestyle choices, it’s not making it on the list.

This category is evolving fast — and that means it’s time for brands to rethink how they align with calendar occasions, in the aisle, across channels, and throughout cultural moments.

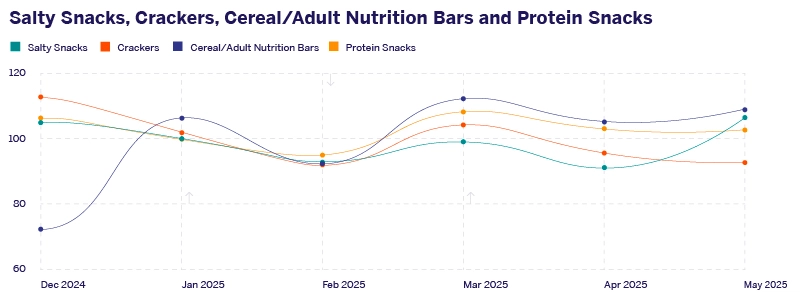

Occasions Shape Snack Purchases

Snack sales spike in December with holiday gatherings and hold through January’s winter routines.1 Then sales dip in February — when the calendar quiets, so do carts as people recover from holidays. March brings them back, with sports, spring breaks, and Easter entertaining driving volume.

If you’re not mapping your advertising and offers to these ups and downs, you’re missing your moment. Mass and club stores already claim 42% of snack sales,2 because they offer the portions and formats people need for these gatherings: multipacks, party sizes, and bundles that feed the group, not just the individual.

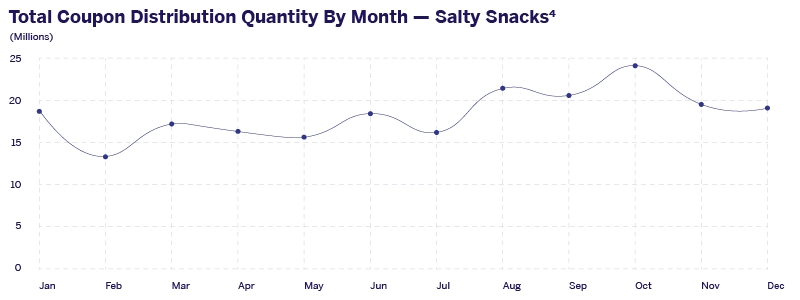

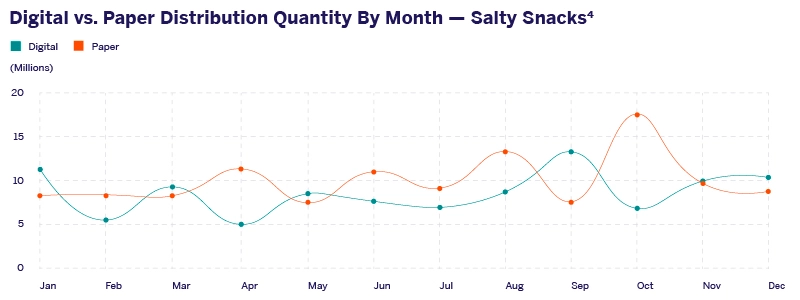

Deals Drive Conversion — But Only If They’re Timed Right

Promotions are still one of the most critical drivers of snack buying. 65% of shoppers build lists around deals3 and half say coupons directly influence their snack purchases.2 Strong redemption rates across the category signal that consumers respond when brands show up with the right offers at the right time.3

But here’s the gap: When February hits and occasions drop off, digital campaigns pause — even as longer-lead paper offers linger. That’s a missed opportunity to keep shoppers engaged. Brands that lean into timely, digital-first deals can fill that void, stay top-of-mind during these slower stretches, and capture incremental trips before spring occasions return.

Value is the ticket here; 83% of shoppers want more personalized offers tied to their behavior, including purchase history.3 But deals need to be strategically targeted, rather than too broadly distributed — this can take shape as digital coupons within social ads, embedded incentives in CTV campaigns, or savings linked directly to seasonal themes like “stock up for spring sports.”

Taste Still Wins — But Health Is the Hook

Consumers say they want healthier snacks: 71% are looking for better-for-you options.5 But when it comes down to adding to the cart, taste is still the #1 driver.2 They’re not compromising. If it’s high-protein but hard to digest, or low-sugar but also low flavor, they’ll pass.

Protein-forward snacks like cheese squares, bars, and meat sticks are holding steady across seasons, having found the sweet spot between function and flavor. Social listening shows why: many consumers praise these snacks for aligning with fitness and health goals, even as others note challenges with taste or digestion.6

Salty snacks are still enjoyed by 80% of consumers, although fresh fruit is not far behind at 73%.5 Crackers, meanwhile, are celebrated for their versatility, showing up in conversations tied to charcuterie boards, dips, and entertaining moments.6 Together, these insights show that consumers want balance — better-for-you choices that also deliver on taste and occasion-based enjoyment.

How To Put the Data Into Action

Win gatherings and routines with occasion-ready value

Multipacks and family-size formats align with spring and winter occasions — from sports to holidays — when baskets naturally expand.

Try this:

Tie bulk promotions to high-volume holiday gatherings and amplify them with creator-driven storytelling that connects your brand to entertaining and family moments. For quick-turn wins, lean into school-year routines still underway, but keep an eye on Q1 occasions where baskets expand again.

Real-world example:

General Mills partnered with Costco and Inmar to position snacks as Game Day essentials, generating $411K in sales, 7.7M impressions, and 38.3% new-to-category buyers.

Turn deals into lasting loyalty

Coupons and promotions don’t just drive trial — when activated digitally, they connect directly to ongoing brand preference and store trips.

Try this:

Deliver value quickly with a mix of incentives — digital coupons, cash back, and personalized deals — then amplify with Offer Media across social, CTV, and in-store. This approach keeps your brand top of mind during holiday peaks and builds habits that last into Q1.

Real-world example:

A salty snack campaign activated at Sprouts retail locations paired digital coupons with media targeting, achieving a 15.9% redemption rate — nearly double the category average — and delivering 2MM+ impressions.

Lead with health (but prove taste)

Consumers are drawn to better-for-you snacks, but they still expect flavor and credibility. Data-driven creator matching and contextual activation can highlight both.

Try this:

Leverage Inmar’s Commerce Fitscore to ensure the right creators spotlight your product’s health benefits while proving flavor, and use MomentsAI to tie campaigns to entertaining occasions. Align with consumers’ growing interest in health and wellness by leveraging Inmar’s GLP-1 targeting data to reach households actively using weight-loss medications, aligning your messaging with a fast-growing, health-focused audience.

Real-world example:

Mondelez leveraged Inmar’s Commerce Fitscore to match with high-performing creators, delivering 1M+ organic views, $12.59 ROAS in 14 days, and attracting 27% first-time buyers.

Ready to fuel smarter, data-driven snack campaigns?

Complete the form to receive a complimentary custom shopper behavior report, built specifically for your brand.

1. Based on monthly sales index from December 2024 to May 2025 from the Inmar Grocery Shopper Panel

2. Statista

3. Inmar Mid-Year Promotions Trends & Shopper Insights

4. Based on transactions recorded in the Inmar Coupon Settlement Database, January-December 2024

5. Drugstorenews

6. 2025 Vendor Social Listening Data, Queried by Inmar Intelligence