What’s Moving in the Beverage Aisle

As we move into the later summer months and into fall, hydration and functional beverages continue to outperform, driven by warm temps, outdoor routines, and consumers’ increasing desire to remain healthy and hydrated. The big question is: what comes next?

As Summer Temps Cool, Fall and Winter Routines Prevail

As summer concludes, consumers reestablish routines, preparing for back-to-school and fall holidays and making more intentional purchase decisions — a trend that will last through the winter holidays. In this critical period, defined by fair weather loyalty and frequent brand switching, hydration remains strong.

Fueled by health and refreshed daily regimens — like school lunches, gym sessions, and wellness rituals — beverages are part of a transition from summer leisure to fall routine. This is an important moment for brands to consider as they seek relevance beyond the traditional summer window.

Key Categorical Highlights:

- Sales of hydration products — including flat bottled water, sports drinks, and enhanced waters — peak in July and maintain momentum into back-to-school and fall sports season, driven by value-pack promotions and bulk stock-up habits.1

- Carbonated beverages spike in July, tied to celebration-driven consumption (July 4th, family gatherings), but interest drops off until November when holiday gatherings ramp up.1

Health Drives Social Conversations & Shapes Decisions

Across social platforms, hydration remains a dominant conversation driver. Keywords like "electrolytes" and "hydrate" peak alongside cultural moments like Earth Day and World Health Day, and are consistently tied to wellness behaviors.2 In general, health and hydration are growing with 26% of beverage consumers planning to drink more canned or bottled water in the coming year, and spending on beverages up almost 5% (this is higher for non-alcoholic than alcoholic beverages).

As health living continues to trend — fueled in part by the rising presence of GLP-1 medications and supplements (now present in over 35% of households) — wellness and quality emerge as dominant themes across beverage-related posts:2

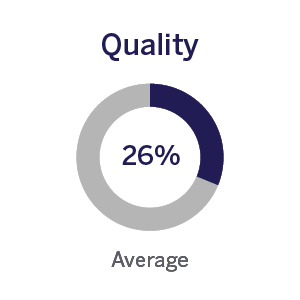

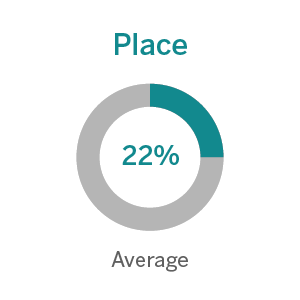

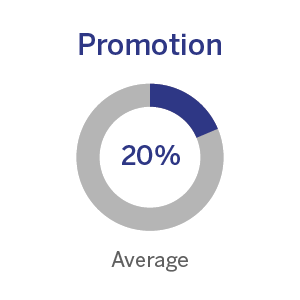

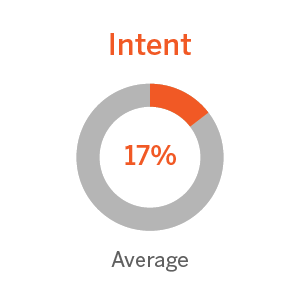

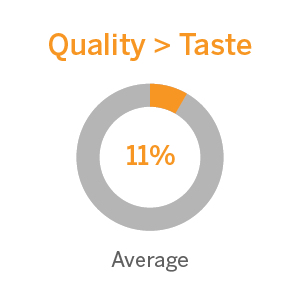

Across all reviewed beverage categories, "Quality" is the #1 theme present in social posts, followed by "Place," (indicating that location or occasion have a major influence on beverage choices) and "Promotion" (indicating that advertising and offers are a major driver of decisions, even over the "Taste" of a beverage).2

Cooler Temps Call for Beverage Promotions

Many brands front-load the summer season with incentives — over 46 million Load-to-Card coupons (digital coupons that consumers can directly add to their loyalty account or shopping app) were distributed in May alone3 — but don’t account for how consumers’ needs will continue to evolve. When we look at Inmar's historical coupon data we see a noticeable drop-off in promotional volume from late summer through the holiday season, leaving the door open for brands to show up with better-timed, more relevant offers tailored to occasions like Back-to-School, the start of early fall sports, preparations for holiday gatherings and meals, and more.

How To Put The Data Into Action

As beverage trends and consumption habits evolve, so do the opportunities to connect with consumers in more relevant ways. Inmar can help you connect with consumers and inspire them to choose your brand by delivering your key benefits to the right audiences at the right time. Consider the following strategies:

Refresh your promotional cadence

Don’t assume early summer offers can carry the seasons that follow. Match incentives to what consumers care about in the moment.

Try this:

Refresh your promotions around key seasonal spikes like back-to-school routines, fall sports and holidays. Partner with Inmar to deliver personalized offers that connect savings to brand benefits, motivating consumers to switch, stock up, and fill their baskets. Activate those offers where consumers are already engaged — digital, social, mobile — and use Inmar’s Offer Media solution to embed incentives directly into media that drives action.

Real-world example:

Gatorade partnered with Inmar to align hydration offers with peak seasonal demand in late summer & early fall, driving a $3.57 iROAS. This proved how delivering well-timed offers can drive growth during a period where incentive availability dries up.

Put health and Hydration front and center.

Consumers are increasingly driven by functional benefits — from hydration and energy to immunity and gut health.

Try this:

Lead with wellness messaging including electrolytes, protein, and low/no sugar, and reframe it through credible voices. Leverage trusted, consumer-centric influencers to amplify your brand’s better-for-you positioning in ways that feel authentic, aspirational, and real. Whether you’re targeting health-conscious parents, GLP-1 users, or gym-goers, Inmar’s HIPAA-compliant first-party health and purchase data helps reach them with personalized messaging. Add rich media and creator content to show how your product fits into wellness routines that drive trial.

Real-world example:

To drive awareness and trial of a healthy beverage brand’s reformulated product at a key retailer, Inmar partnered with creators to produce engaging, educational content on social media and amplify that content across CTV, targeting with 1st-party data during key moments, driving a 3x higher CTR than benchmark and a 100% ROAS; over 100% higher than expected.

Align messaging with the moment.

As consumers shift from summer leisure to fall and winter routines, messaging that reflects that change resonates most.

Try this:

Tie your product’s story to real-life moments like early school mornings, post-workout hydration, and after-school commutes. Inmar’s MomentsAI aligns messaging and creative with the exact times and places consumers are most receptive, whether they’re scrolling, shopping, or walking through the aisle. Add immersive, consumer-first media experiences like short-form video or swipeable formats to capture attention in a category where impulse plays a major role.

Real-world example:

A protein brand leveraged Inmar’s 1st-party data to reach consumers in receptive moments as fall routines got back on track, educating buyers on how their beverage product helps build strength for everyday needs — driving an 11% sales lift and $361k in incremental sales.

Ready to fuel smarter, data-driven beverage campaigns?

Complete the form to receive a complimentary custom shopper behavior report, built specifically for your brand.

1. Based on data reported by NielsenIQ through its RMS Service for Beverage products across all departments and categories at Grocery, Drug, Mass, Club, Military and Dollar channels for the 52-week period ending 4/19/2025

2. 2025 Vendor Social Listening Data, Queried by Inmar Intelligence

3. Based on transactions recorded in the Inmar Coupon Settlement Database, January-December 2024